UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx☒ �� Filed by a Party other than the Registrant¨☐

Check the appropriate box:

| | |

¨☐ | | Preliminary Proxy Statement |

| |

¨☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x☒ | | Definitive Proxy Statement |

| |

¨☐ | | Definitive Additional Materials |

| |

¨☐ | | Soliciting Material Pursuant to § 240.14a-12 |

Texas Instruments Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

x☒ | | No fee required. |

| |

¨☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of the transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

¨☐ | | Fee paid previously with preliminary materials. |

| |

¨☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 21, 201626, 2018

Dear Stockholder:

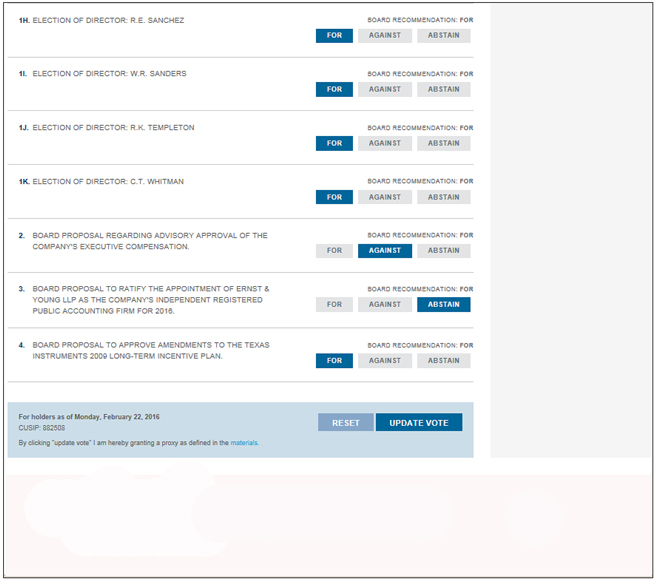

You are cordially invited to attend the 20162018 annual meeting of stockholders on Thursday, April 21, 2016, at26, 2018, in the cafeteriaauditorium on our property at 12500 TI Boulevard, Dallas, Texas, at 9:008:30 a.m. (Central time). See “Attendance requirements” for important information about attending the annual meeting. At the meeting we will consider and act upon the following matters:

the election of directors for the next year,

advisory approval of the company’s executive compensation,

approval of the Texas Instruments 2018 Director Compensation Plan,

ratification of the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm for 2016,

approval of amendments to the Texas Instruments 2009 Long-Term Incentive Plan,2018, and

such other matters as may properly come before the meeting.

Stockholders of record at the close of business on February 22, 2016,26, 2018, are entitled to vote at the annual meeting.

We urge you to vote your shares as promptly as possible by: (1) accessing the Internetinternet website, (2) calling the toll-free number or (3) signing, dating and mailing the enclosed proxy.

Sincerely,

Cynthia Hoff Trochu

Senior Vice President,

Secretary and

General Counsel

Dallas, Texas

March 9, 2016

13, 2018

| | | | |

| | TEXAS INSTRUMENTS • 20162018 PROXY STATEMENT | | 1 |

TABLE OF CONTENTS

| | | | |

2 | | TEXAS INSTRUMENTS • 20162018 PROXY STATEMENT | | |

PROXY STATEMENT – MARCH 9, 201613, 2018

EXECUTIVE OFFICES

12500 TI BOULEVARD, DALLAS, TEXASTX 75243

MAILING ADDRESS: P.O. BOX 660199, DALLAS, TEXASTX 75266-0199

Voting procedures, quorum and quorumattendance requirements

TI’s board of directors requests your proxy for the annual meeting of stockholders on April 21, 2016.26, 2018. If you sign and return the enclosed proxy, or vote by telephone or on the Internet,internet, you authorize the persons named in the proxy to represent you and vote your shares for the purposes mentioned in the notice of annual meeting. This proxy statement and related proxy are being distributed on or about March 9, 2016.13, 2018. If you come to the meeting, you can vote in person. If you do not come to the meeting, your shares can be voted only if you have returned a properly signed proxy or followed the telephone or Internetinternet voting instructions, which can be found on the enclosed proxy. If you sign and return your proxy but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the board of directors. You can revoke your authorization at any time before the shares are voted at the meeting.

A quorum of stockholders is necessary to hold a valid meeting. If at least a majority of the shares of TI common stock issued and outstanding and entitled to vote are present in person or by proxy, a quorum will exist. Abstentions and brokernon-votes are counted as present for purposes of establishing a quorum. Brokernon-votes occur when a beneficial owner who holds company stock through a broker does not provide the broker with voting instructions as to any matter on which the broker is not permitted to exercise its discretion and vote without specific instruction.

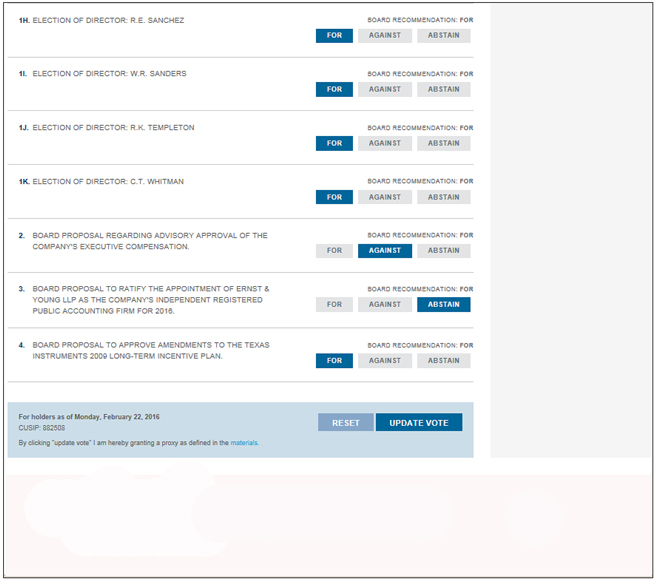

ScheduledShown below is a list of the matters to be considered at the meeting are the election(each of directors, an advisory vote regarding approval of the company’s executive compensation, ratification of the appointment of our independent registered public accounting firm and approval of amendments to the Texas Instruments 2009 Long-Term Incentive Plan. Each of these matterswhich is discussed elsewhere in this proxy statement. On each of these matters you may vote “for,” “against” or “abstain.” Thestatement), and the vote required for election or approval, as the election of directors and approval of the other matters is shown in the table below.case may be.

| | | | |

| Matter | | Required Vote for Election or Approval | | Impact of Abstentions or Broker Non-Votes |

Election of directorsdirectors. | | Majority of votes present in person or by proxy at the meeting and entitled to be cast in the election with respect to a nominee must be cast for that nominee. | | Abstentions have the same effect as votes against. Brokernon-votes are not counted as votes for or against. |

Advisory vote to approve named executive officer compensation. | | Majority of votes present in person or by proxy at the meeting must be cast for the proposal. | | Abstentions and brokernon-votes have the same effect as votes against. |

Proposal to approve the Texas Instruments 2018 Director Compensation Plan. | | Majority of votes present in person or by proxy at the meeting must be cast for the proposal. | | Abstentions and brokernon-votes have the same effect as votes against. |

Proposal to ratify appointment of independent registered public accounting firm. | | Majority of votes present in person or by proxy at the meeting must be cast for the proposal. | | Abstentions have the same effect as votes against. (Brokers are permitted to exercise their discretion and vote without specific instruction on this matter. Accordingly, there are no brokernon-votes.) |

Proposal to approve amendments to Any other matter that may properly be submitted at the Texas Instruments 2009 Long-Term Incentive Plan.meeting. | | Majority of votes present in person or by proxy at the meeting must be cast for the proposal. | | Abstentions and brokernon-votes have the same effect as votes against. |

Any other matter that may properly be submitted at the meeting. | | Majority of votes present in person or by proxy at the meeting must be cast for the proposal. | | Abstentions and broker non-votes have the same effect as votes against. |

| | | | |

| | TEXAS INSTRUMENTS • 20162018 PROXY STATEMENT | | 3 |

Attendance requirements

Attendance at the meeting is limited to stockholders or their legal proxy holders. Each attendee must present a government-issued photo ID and an advance registration form.

If you plan to attend the annual meeting in person, you must print your own advance registration form and bring it to the meeting to gain access.

Advance registration forms can be printed by clicking on the “Register for Meeting” button found at www.proxyvote.com and following the instructions provided. You will need the16-digit control number included on your notice, proxy card or voting instruction form. You must request your advance registration form by 11:59 p.m. April 25, 2018.

If you are unable to print your advance registration form, please call Stockholder Meeting Registration Phone Support (toll free) at 1-844-318-0137 or (international toll call) at1-925-331-6070 for assistance.

On the day of the meeting, you will be required to present valid government-issued photo ID, such as a driver’s license or passport, with your advance registration form. You may be denied entrance if the required identification and form are not presented.

Guest advance registration forms are not available. Exceptions may be granted to stockholders who require a companion in order to facilitate their own attendance (for example, due to a physical disability) by contacting Investor Relations.

Additionally, if you plan to attend as proxy for a stockholder of record, you must present a valid legal proxy from the stockholder of record to you. If you plan to attend as proxy for a street name stockholder, you must present a valid legal proxy from the stockholder of record (i.e., the bank, broker or other holder of record) to the street name stockholder that is assignable and a valid legal proxy from the street name stockholder to you. Stockholders may appoint only one proxy holder to attend on their behalf.

| | | | |

4 | | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | |

Election of directors

Directors are elected at the annual meeting to hold office until the next annual meeting and until their successors are elected and qualified. The board of directors has designated the following persons as nominees: RALPH W. BABB, JR., MARK A. BLINN, TODD M. BLUEDORN, DANIEL A. CARP, JANET F. CLARK, CARRIE S. COX, BRIAN T. CRUTCHER, JEAN M. HOBBY, RONALD KIRK, PAMELA H. PATSLEY, ROBERT E. SANCHEZ WAYNE R. SANDERS,and RICHARD K. TEMPLETON and CHRISTINE TODD WHITMAN.TEMPLETON.

If you return a proxy that is not otherwise marked, your shares will be voted FOR each of the nominees.

Nominees for directorship

All of the nominees for directorship are directors of the company. For a discussion of each nominee’s qualifications to serve as a director of the company, please see pages 6-8.“Board diversity and nominee qualifications.” If any nominee becomes unable to serve before the meeting, the persons named as proxies may vote for a substitute or the number of directors will be reduced accordingly.

Directors

| | | | | | | | | | |

| | RALPH W. BABB, JR. Age 6769 Director since 2010 Lead Director;

Chair, Audit Committee

| |  | | CARRIE S. COX

Age 58

Director since 2004

Member, Governance and Stockholder Relations Committee | |

| | WAYNE R. SANDERSJANET F. CLARK

Age 6863 Director since 1997 2015Chair, Governance andMember,Audit Committee | |  | | RONALD KIRK Age 63 Director since 2013Member, Governance and Stockholder Relations Committee |

| | | | | |

| | MARK A. BLINN Age 5456 Director since 2013 Member,Chair, Audit Committee

| |   | | RONALD KIRKCARRIE S. COX

Age 6160 Director since 20132004 Member, Governance and Stockholder Relations Committee | |  | | RICHARD K. TEMPLETON

Age 57

Chairman since 2008 and director since 2003

|

| | | | | |

| | DANIEL A. CARP

Age 67

Director since 1997Member, Compensation Committee

| |   | | PAMELA H. PATSLEY Age 5961 Director since 2004Member, Compensation Committee | |  | | CHRISTINE TODD

WHITMAN

Age 69

Director since 2003

Member, Compensation Committee |

| | | | | |

| | JANET F. CLARKTODD M. BLUEDORN

Age 6154 Director since 20152017Member, Audit Committee | |   | | BRIAN T. CRUTCHER Age 45 Director since 2017 | |  | | ROBERT E. SANCHEZ Age 5052 Director since 2011 Chair, Compensation Committee |

| | | | | |

| | DANIEL A. CARP Age 69 Director since 1997Member, Compensation Committee | |  | | JEAN M. HOBBY Age 57 Director since 2016Member, Audit Committee | |  | | RICHARD K. TEMPLETON Age 59 Chairman since 2008 and director since 2003 |

| | | | |

4

| | TEXAS INSTRUMENTS • 20162018 PROXY STATEMENT | | 5 |

Director not standing forre-election

| | |

| | RUTH J. SIMMONSWAYNE R. SANDERS

Age 70 Director since 1999Lead Director;

Member, AuditChair, Governance and

Stockholder Relations Committee |

Ms. Simmons,Mr. Sanders, a highly valued director since 1999,1997, has attained the age of 70 and is therefore ineligible under the company’sby-laws to stand forre-election at the 20162018 annual meeting. Subject to their re-election by stockholders, Mr. Blinn and Mr. Kirk have been duly elected as new lead director and new GSR chair, respectively, to take effect immediately following the 2018 annual meeting of stockholders.

Director nomination process

The board is responsible for approving nominees for election as directors. To assist in this task, the board has designated a standing committee, the Governance and Stockholder Relations Committee (the G&SRGSR Committee), which is responsible for reviewing and recommending nominees to the board. The G&SRGSR Committee is comprised solely of independent directors as defined by the rules of Thethe NASDAQ Stock Market (NASDAQ) and the board’s corporate governance guidelines. Our board of directors has adopted a written charter for the G&SRGSR Committee. It can be found on our website atwww.ti.com/corporategovernance.corporategovernance.

Director candidate recommendations

It is a long-standing policy of the board to consider prospective board nominees recommended by stockholders. A stockholder who wishes to recommend a prospective board nominee for the G&SRGSR Committee’s consideration can write to the Secretary of the G&SRGSR Committee, Texas Instruments Incorporated, P.O. Box 655936, MS 8658, Dallas, TX 75265-5936. The G&SRGSR Committee will evaluate the stockholder’s prospective board nominee in the same manner as it evaluates other nominees.

Criteria

In evaluating prospective nominees, the G&SRGSR Committee looks for the following minimum qualifications, qualities and skills:

Outstanding achievement in the individual’s personal career.

Breadth ofRelevant commercial expertise.

International operations experience.

Financial acumen.

Government experience.

Soundness of judgment.

Ability to make independent, analytical inquiries.

Ability to contribute to a diversity of viewpoints among board members.

Willingness and ability to devote the time required to perform board activities adequately (in this regard, the G&SR Committee will consider the number of other boards on which the individual serves as a director, and in particular the board’s policy that directors should not serve on the boards of more than three other public companies).

Ability to represent the total corporate interests of TI (a director will not be selected to, nor will he or she be expected to, represent the interests of any particular group).

Board diversity (viewpoints, gender, ethnicity).

Willingness and ability to devote the time required to perform board activities adequately. Directors should not serve on the boards of more than three other public companies.

Stockholders, non-employeeOutside board memberships

In evaluating prospective nominees, the GSR Committee will consider the number of other boards on which the individual serves as director, and in particular the board’s policy that directors management and others may submit recommendationsshould not serve on the boards of more than three other public companies.

The board is sensitive to the G&SR Committee.fact that a director’s service in an executive role at another company can be time consuming. In this regard, the board reviewed Mr. Bluedorn’s outside directorships at Lennox International, Inc. and Eaton Corporation, plc, and determined that they enhance the breadth and depth of experience on the board. Because of these directorships, Mr. Bluedorn brings to the company a unique combination of specialized knowledge and experience in the industrial market, an area in which the company has publicly disclosed its intent to focus R&D investments. He also brings a familiarity with the challenges posed by

| | | | |

6 | | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | |

complex international manufacturers. Additionally, Mr. Bluedorn has held senior management positions at United Technologies, such as leading its Otis Elevator and Carrier (HVAC) business, that provide the board with important perspective on the industrial market.

There is a strong consensus among the directors that Mr. Bluedorn is willing and able to devote the time required to perform board activities, and that his service with Lennox and Eaton will not interfere with his duties to the company and its shareholders. Mr. Bluedorn has served on the boards of Lennox and Eaton since 2007 and 2010, respectively, so his familiarity with his roles and responsibilities at those organizations enables him to devote the balance of his time to his service on the board. Also, two of Mr. Bluedorn’s directorships (Lennox and TI) are located within ten miles of each other in the Dallas, Texas area, and Mr. Bluedorn’s exemplary attendance record at both Lennox and Eaton, as well as at the company, indicate his commitment to devoting sufficient time to board duties.

Stockholder nomination of directors

Under the company’sby-laws, a stockholder, or a group of up to 20 stockholders, owning at least 3 percent of the company’s outstanding common stock continuously for at least three years, may nominate and include in the company’s proxy materials director nominees constituting up to the greater of two individuals or 20 percent of the board of directors, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in theby-laws.

The company’sby-laws also allow stockholders to nominate directors without involving the GSR Committee or including the nominee in the company’s proxy materials. To do so, stockholders must comply with the requirements set forth in theby-laws, which can be found on our website at www.ti.com/corporategovernance.

Director nominees

All nominees for directorship are currently directors of the company. Ms. Clarkcompany, including Mr. Crutcher, who was elected to the board effective July 15, 2015. She19, 2017. He is the only director nominee at the 20162018 annual meeting of stockholders who is standing for election by the stockholders for the first time. A search firm retained by the company to assist the G&SR Committee in identifying and evaluating potential nominees initially identified Ms. Clark as a potential director candidate. The search firm conducted research to identify a number of potential candidates, based on qualifications and skills the G&SR Committee determined that candidates should possess. It then conducted further research on the candidates in whom the G&SR Committee had the most interest.

The board believes its current size is within the desired range as stated in the board’s corporate governance guidelines.

Board diversityDiversity and nominee qualifications

As indicated by the criteria above, the board prefers a mix of background and experience among its members. The board does not follow any ratio or formula to determine the appropriate mix. Rather, it uses its judgment to identify nominees whose backgrounds, attributes and experiences, taken as a whole, will contribute to the high standards of board service at the company. Maintaining a balance of tenure among the directors is part of the board’s consideration. Longer-serving directors bring valuable experience with

| | | | |

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | 5 |

the company and familiarity with the strategic and operational challenges it has faced over the years, while newer directors bring fresh perspectives and ideas. To help maintain this balance, the company has a mandatory retirement policy, pursuant to which directors cannot stand for election after reaching age 70. The effectiveness of the board’s approach to board composition decisions is evidenced by the directors’ participation in the insightful and robust, yet respectful, deliberation that occurs at board and committee meetings, and in shaping the agendas for those meetings.

Nominee assessment

As it considered director nominees for the 20162018 annual meeting, the board kept in mind that the most important issues it considers typically relate to the company’s strategic direction; succession planning for senior executive positions; the company’s financial performance; the challenges of running a large, complex enterprise, including the management of its risks; major acquisitions and divestitures; and significant research and development (R&D) and capital investment decisions. These issues arise in the context of the company’s operations, which primarily involve the manufacture and sale of semiconductors all over the world into industrial, automotive, personal electronics, communications equipment and enterprise systems markets.

As described below, each of our director nominees has achieved an extremely high level of success in his or her career, whether at multi-billion dollar, multinational corporate enterprises or significant governmental organizations. In these positions, each has been directly involved in the challenges relating to setting the strategic direction and managing the financial performance, personnel and processes of large, complex organizations. Each has had exposure to effective leaders and has developed the ability to judge leadership qualities. Ten of the director nominees have experience in serving on the board of directors of at least one other major corporation, and two haveone has served in high political office, all of which provides additional relevant experience on which each nominee can draw.

| | | | |

| | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | 7 |

In concluding that each nominee should serve as a director, the board relied on the specific experiences and attributes listed below and on the direct personal knowledge, born of previous service on the board, that each of the nominees brings insight and theto board deliberations as well as a willingness to ask difficult questions to board deliberations.challenging questions.

Mr. Babb

As chairman and CEO of Comerica Incorporated and Comerica Bank (2002-present) and through a long career in banking, has gained first-hand experience in managing large, complex institutions, as well as insight into financial markets.

As Audit Committee chair at the company (April 19, 2013-present)(2013-April 20, 2017), chief financial officer of Comerica Incorporated and Comerica Bank (1995-2002), controller and later chief financial officer of Mercantile Bancorporation (1978-1995), and auditor and later audit manager at the accounting firm of Peat Marwick Mitchell & Co. (1971-1978), has gained extensive audit knowledge and experience in audit- and financial control-related matters.

Mr. Blinn

As CEO and a director of Flowserve Corporation (2009-present)(2009-2017), has gained first-hand experience in managing a large, multinational corporation operating in global industrial markets, with ultimate management responsibility for the organization’s financial performance and significant capital and R&D investments.

As Audit Committee chair at the company (April 21, 2017-present), chief financial officer of Flowserve Corporation (2004-2009), chief financial officer of FedEx Kinko’s Office and Print Services Inc. (2003-2004) and vice president and controller of Centex Corporation (2000-2002), has developed a keen appreciation for audit- and financial control-related matters. Is also a director of Kraton Corporation (2017-present).

Mr. Bluedorn

As chairman (2012-present) and CEO and a director (2007-present) of Lennox International Inc., has gained first-hand experience in managing a large, multinational corporation operating in global industrial markets, with ultimate management responsibility for the corporation’s financial performance and its significant investments in capital and R&D. Is also a director of Eaton Corporation plc (2010-present).

Mr. Carp

As chairman and CEO (2000-2005) and president (1997-2001, 2002-2003) of Eastman Kodak Company, has gained first-hand experience in managing a large, multinational corporation focused on worldwide electronics markets, with ultimate management responsibility for the corporation’s financial performance and its significant investments in capital and R&D.

As chairman of the board of directorsa director of Delta Air Lines, Inc. (2007-present), a director of Norfolk Southern Corporation (2006-present) and a director of Liz Claiborne, Inc. (2006-2009), has helped oversee the strategy and operations of major multinational corporations in various industries, including some that are capital-intensive.

Ms. Clark

As executive vice president (2007-2013) and chief financial officer (2004-2013) of Marathon Oil Corporation, has developed a keen appreciation for audit- and financial control-related matters.

| | | | |

6

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | |

As a director of Goldman Sachs Private Middle Market Credit LLC (2016-present), Goldman Sachs BDC, Inc. (2015-present) and EOG Resources, Inc. (2014-present) and as a former director of Exterran Holdings, Inc. (and its predecessor company, Universal Compression Holdings, Inc.) (2003-2011) and Dell Inc. (2011-2013), has helped oversee the strategy and operations of other large, multinational corporations, including one with a focus on technology.

Ms. Cox

As chairman (2013-present), CEO and a director (2010-present) of Humacyte, Inc., executive vice president and president of Global Pharmaceuticals at Schering-Plough Corporation (2003-2009) and executive vice president and president of Global Prescription Business at Pharmacia Corporation (1997-2003), has gained first-hand experience in managing large, multinational organizations focused on medical-related markets, with responsibility for those organizations’ financial performance and significant capital and R&D investments. Is also a director of Cardinal Health, Inc. (2009-present) and Celgene Corporation (2009-present).

| | | | |

8 | | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | |

Mr. Crutcher

As a TI employee for over 20 years, serving the last seven years at a senior level at the company, including senior vice president (2010-2014), executive vice president (2014-present), chief operating officer (January 19, 2017-present) and director (July 19, 2017-present), has experience leading large, complex semiconductor operations and keen insight into the current and future state of the semiconductor industry.

Ms. Hobby

As global strategy officer (2013-2015), technology, media and telecom sector leader (2008-2013) and chief financial officer (2005-2008) at PricewaterhouseCoopers LLP, has gained extensive audit knowledge and experience in audit- and financial control-related matters and technology.

As a director of Integer Holdings Corporation (and its predecessor company, Greatbatch, Inc.) (2015-present), and CA, Inc. (February 1, 2018-present), has helped oversee the strategy and operations of other multinational corporations.

Mr. Kirk

As U.S. Trade Representative (2009-2013), has gained first-hand experience in managing a complex organization that operates on an international scale and developed insight into issues bearing on global economic activity, international trade policies and strategies and the workings of foreign governments.

As Senior Of Counsel of Gibson, Dunn & Crutcher LLP (2013-present), and as a partner of Vinson & Elkins, LLP (2005-2009), has gained first-hand experience as an advisor to numerous multinational companies.

As a director of Brinker International, Inc. (1997-2009) and, Dean Foods Company (1997-2009), and Macquarie Infrastructure Corporation (2016-present), has helped oversee the strategy and operations of other large corporations.

Ms. Patsley

As executive chairman (2016-present)(2016-February 2, 2018) and chairman and CEO (2009-2015) of MoneyGram International, Inc., senior executive vice president of First Data Corporation (2000-2007) and president and CEO of Paymentech, Inc. (1991-2000), has gained first-hand experience in managing large, multinational organizations, including the application of technology in the financial services sector, with ultimate management responsibility for their financial performance and significant capital investments.

As Audit Committee chair at the company (2006-April 18, 2013)(2006-2013), a member of the audit committee at Dr Pepper Snapple Group, Inc., chief financial officer of First USA, Inc. (1987-1994) and an auditor at KPMG Peat Marwick for almost six years before joining First USA, has developed a keen appreciation for audit- and financial control-related matters.

As a director of Dr Pepper Snapple Group, Inc. (2008-present), Hilton Grand Vacations, Inc. (January 2017-present) and a director of Molson Coors Brewing Company (2005-2009), has helped oversee the strategy and operations of other major multinational corporations.

Mr. Sanchez

As chairman and CEO (2013-present), president (2012-2014) and chief operating officer (2012) of Ryder System, Inc., and as president of its Global Fleet Management Solutions business segment (2010-2012), has gained first-hand experience in managing a large, multinational, transportation-related organization, with responsibility for the organization’s financial performance and significant capital investments.

As executive vice president and chief financial officer (2007-2010) and as senior vice president and chief information officer (2003-2005) of Ryder System, Inc., has developed a keen appreciation for audit- and financial control-related issues and gained first-hand experience with all technology-related functions of a large, multinational corporation focused on transportation and logistics.

Mr. Sanders

As chairman (1992-2003) and CEO (1991-2002) of Kimberly-Clark Corporation, has gained first-hand experience in managing a large, multinational consumer goods corporation, with ultimate management responsibility for its financial performance and its significant capital and R&D investments.

As chairman of Dr Pepper Snapple Group, Inc. (2008-present) and a director of Belo Corporation (2003-2013), has helped oversee the strategy and operations of other large corporations.

| | | | |

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | 7 |

Mr. Templeton

As a 35-year37-year veteran of the semiconductor industry, serving the last 2022 years at a senior level at the company, including as chairman since 2008, CEO since 2004 and director since 2003, has developed a deep knowledge of all aspects of the company and of the semiconductor industry.

Ms. Whitman

| | | | |

| | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | 9 |

As Administrator of the Environmental Protection Agency (2001-2003) and Governor of the State of New Jersey (1994-2000), has gained first-hand experience managing a large, complex organization and developed keen insight into the workings of government on the federal and state level and how they might impact company operations.

As a director of S.C. Johnson & Son, Inc. (2003-present) and United Technologies Corp. (2003-present), has helped oversee the strategy and operations of other large corporations.

Communications with the board

Stockholders and others who wish to communicate with the board, a board committee or an individual director may write to them at: P.O. Box 655936, MS 8658, Dallas, TX 75265-5936. All communications sent to this address will be shared with the board, committee or individual director as applicable.

Corporate governance

The board has a long-standing commitment to responsible and effective corporate governance. We annually conduct extensive governance reviews and engage in investor outreach specific to governance and executive compensation matters. The board’s corporate governance guidelines (which include the director independence standards), the charters of each of the board’s committees, TI’s code of conduct, and our code of ethics for our CEO and senior financial officers and ourby-laws are available on our website at www.ti.com/corporategovernance. Stockholders may request copies of these documents free of charge by writing to Texas Instruments Incorporated, P.O. Box 660199, MS 8657, Dallas, TX 75266-0199, Attn: Investor Relations.

Annual meeting attendance

It is a policy of the board to encourage directors to attend each annual meeting of stockholders. Such attendance allows for direct interaction between stockholders and board members. In 2015,2017, all directors then in office and standing forre-election attended TI’s annual meeting of stockholders.

Director independence

The board has determined that each of our directors is independent except for Mr. Templeton.Templeton and Mr. Crutcher. In connection with this determination, information was reviewed regarding directors’ business and charitable affiliations, directors’ immediate family members and their employers, and any transactions or arrangements between the company and such persons or entities. The board has adopted the following standards for determining independence.

| A. | In no event will a director be considered independent if: |

| | 1. | He or she is a current partner of or is employed by the company’s independent auditors; |

| | 2. | A family member of the director is (a) a current partner of the company’s independent auditors or (b) currently employed by the company’s independent auditors and personally works on the company’s audit; |

| | 3. | Within the current or preceding three fiscal years he or she was, and remains at the time of the determination, a partner in or a controlling shareholder, an executive officer or an employee of an organization that in the current year or any of the past three fiscal years (a) made payments to, or received payments from, the company for property or services, (b) extended loans to or received loans from, the company, or (c) received charitable contributions from the company, in an amount or amounts which, in the aggregate in such fiscal year, exceeded the greater of $200,000 or 2 percent of the recipient’s consolidated gross revenues for that year (for purposes of this standard, “payments” excludes payments arising solely from investments in the company’s securities and payments undernon-discretionary charitable contribution matching programs); or |

| | 4. | Within the current or preceding three fiscal years a family member of the director was, and remains at the time of the determination, a partner in or a controlling shareholder or an executive officer of an organization that in the current year or any of the past three fiscal years (a) made payments to, or received payments from, the company for property or |

| | | | |

8

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | |

| services, (b) extended loans to or received loans from the company, or (c) received charitable contributions from the company, in an amount or amounts which, in the aggregate in such fiscal year, exceeded the greater of $200,000 or 2 percent of the recipient’s consolidated gross revenues for that year (for purposes of this standard, “payments” excludes payments arising solely from investments in the company’s securities and payments undernon-discretionary charitable contribution matching programs). |

| B. | In no event will a director be considered independent if, within the preceding three years: |

| | 1. | He or she was employed by the company (except in the capacity of interim chairman of the board, chief executive officer or other executive officer, provided the interim employment did not last longer than one year); |

| | 2. | He or she received more than $120,000 during any twelve-month period in compensation from the company (other than (a) compensation for board or board committee service, (b) compensation received for former service lasting no longer than one year as an interim chairman of the board, chief executive officer or other executive officer and (c) benefits under atax-qualified retirement plan, ornon-discretionary compensation); |

| | 3. | A family member of the director was employed as an executive officer by the company; |

| | | | |

10 | | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | |

| | 4. | A family member of the director received more than $120,000 during any twelve-month period in compensation from the company (excluding compensation as anon-executive officer employee of the company); |

| | 5. | He or she was (but is no longer) a partner or employee of the company’s independent auditors and worked on the company’s audit within that time; |

| | 6. | A family member of the director was (but is no longer) a partner or employee of the company’s independent auditors and worked on the company’s audit within that time; |

| | 7. | He or she was an executive officer of another entity at which any of the company’s current executive officers at any time during the past three years served on that entity’s compensation committee; or |

| | 8. | A family member of the director was an executive officer of another entity at which any of the company’s current executive officers at any time during the past three years served on that entity’s compensation committee. |

| C. | No member of the Audit Committee may accept directly or indirectly any consulting, advisory or other compensatory fee from the company, other than in his or her capacity as a member of the board or any board committee. Compensatory fees do not include the receipt of fixed amounts of compensation under a retirement plan (including deferred compensation) for prior service with the company (provided that such compensation is not contingent in any way on continued service). In addition, no member of the Audit Committee may be an affiliated person of the company except in his or her capacity as a director. |

| D. | With respect to service on the Compensation Committee, the board will consider all factors that it deems relevant to determining whether a director has a relationship to the company that is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member, including but not limited to: |

| | 1. | The source of compensation of the director, including any consulting, advisory or compensatory fee paid by the company to the director; and |

| | 2. | Whether the director is affiliated with the company, a subsidiary of the company or an affiliate of a subsidiary of the company. |

| E. | For any other relationship, the determination of whether it would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities, and consequently whether the director involved is independent, will be made by directors who satisfy the independence criteria set forth in this section. |

For purposes of these independence determinations, “company” and “family member” will have the same meaning as under NASDAQ rules.

Board organization

Board and committee meetings

During 2015,2017, the board held nine meetings. The board has three standing committees described below. The committees of the board collectively held 2418 meetings in 2015.2017. Each director attended at least 8486 percent of the board and relevant committee meetings combined. Overall attendance at board and committee meetings was approximately 96 percent.

| | | | |

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | 9 |

Committees of the board

Audit Committee

The Audit Committee is a separately designated standing committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. All members of the Audit Committee are independent under NASDAQ rules and the board’s corporate governance guidelines. From July 20, 2016, to April 18, 2014, to July 14, 2015,20, 2017, the committee members were Mr. Babb (Chair), Mr. Blinn and Ms. Simmons. Since July 15, 2015, the committee members have been Mr. Babb (chair), Mr. Blinn, Ms. Clark and Ms. Simmons.Hobby, with Mr. Bluedorn joining the committee March 1, 2017. Since April 21, 2017, the committee members have been Mr. Blinn (chair), Mr. Bluedorn, Ms. Clark and Ms. Hobby. The Audit Committee is generally responsible for:

Appointing, compensating, retaining and overseeing TI’s independent registered public accounting firm.

Reviewing the annual report of TI’s independent registered public accounting firm related to quality control.

Reviewing TI’s annual and quarterly reports to the SEC, including the financial statements and the “Management’s Discussion and Analysis” portion of those reports, and recommending appropriate action to the board.

Reviewing TI’s audit plans.

Reviewing before issuance TI’s news releases regarding annual and interim financial results and discussing with management any related earnings guidance that may be provided to analysts and rating agencies.

| | | | |

| | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | 11 |

Discussing TI’s audited financial statements with management and the independent registered public accounting firm, including a discussion with the firm regarding the matters required to be reviewed under applicable legal or regulatory requirements.

Reviewing relationships between the independent registered public accounting firm and TI.

Reviewing and discussing the adequacy of TI’s internal accounting controls and other factors affecting the integrity of TI’s financial reports with management and with the independent registered public accounting firm.

Creating and periodically reviewing TI’s whistleblower policy.

Reviewing TI’s risk assessment and risk management policies.

Reviewing TI’s compliance and ethics program.

Reviewing a report of compliance of management and operating personnel with TI’s code of conduct, including TI’s conflict of interest policy.

Reviewing TI’snon-employee-related insurance programs.

Reviewing changes, if any, in major accounting policies of the company.

Reviewing trends in accounting policy changes that are relevant to the company.

Reviewing the company’s policy regarding investments and financial derivative products.

The board has determined that all members of the Audit Committee are financially sophisticated, as the board has interpreted such qualifications in its business judgment. In addition, the board has designated Mr. BabbBlinn as the audit committee financial expert as defined in the Securities Exchange Act of 1934, as amended.

The Audit Committee met tensix times in 2015.2017. The Audit Committee holds regularly scheduled meetings and reports its activities to the board. The committee also continued its long-standing practice of meeting directly with our internal audit staff to discuss the audit plan and to allow for direct interaction between Audit Committee members and our internal auditors. Please see pages 40-41See page 43 for a report of the committee.

Compensation Committee

All members of the Compensation Committee are independent. From April 18, 2014,21, 2016, to April 16, 2015,20, 2017, the committee members were Mr. Sanchez (chair), Ms. Patsley and Ms. Whitman. Since April 17, 2015, the committee members have been Mr. Sanchez (chair), Mr. Carp, Ms. Patsley and Christine Todd Whitman (who retired from the board in April 2017). Since April 21, 2017, the committee members have been Mr. Sanchez (Chair), Mr. Carp and Ms. Whitman.Patsley. The committee is responsible for:

Reviewing the performance of the CEO and determining his compensation.

Setting the compensation of the company’s other executive officers.

Overseeing administration of employee benefit plans.

Making recommendations to the board regarding:

| | ¡ | | Institution and termination of, revisions in and actions under employee benefit plans that (i) increase benefits only for officers of the company or disproportionately increase benefits for officers of the company more than other employees of the company, (ii) require or permit the issuance of the company’s stock or (iii) therequire board must approve.approval. |

| | ¡ | | Reservation of company stock for use as awards of grants under plans or as contributions or sales to any trustee of any employee benefit plan. |

| | | | |

10

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | |

Taking action as appropriate regarding the institution and termination of, revisions in and actions under employee benefit plans that are not required to be approved by the board.

Appointing, setting the compensation of, overseeing and considering the independence of any compensation consultant or other advisor.

The Compensation Committee met six times in 2015.2017. The Compensation Committee holds regularly scheduled meetings, reports its activities to the board, and consults with the board before setting annual executive compensation. Please seeSee page 2830 for a report of the committee.

In performing its functions, the committee is supported by the company’s Human Resources organization. The committee has the authority to retain any advisors it deems appropriate to carry out its responsibilities. The committee retained Pearl Meyer & Partners as its compensation consultant for the 20152017 compensation cycle. The committee instructed the consultant to advise it directly on executive compensation philosophy, strategies, pay levels, decision-making processes and other matters within the scope of the committee’s charter. Additionally, the committee instructed the consultant to assist the company’s Human Resources organization in its support of the committee in these matters with such items as peer-group assessment, analysis of the executive compensation market, and compensation recommendations.

| | | | |

12 | | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | |

The Compensation Committee considers it important that its compensation consultant’s objectivity not be compromised by other engagements with the company or its management. In support of this belief, the committee has a policy on compensation consultants, a copy of which may be found on www.ti.com/corporategovernance. During 2015,2017, the committee determined that its compensation consultant was independent of the company and had no conflict of interest.

The Compensation Committee considers executive compensation in a multistep process that involves the review of market information, performance data and possible compensation levels over several meetings leading to the annual determinations in January. Before setting executive compensation, the committee reviews the total compensation and benefits of the executive officers and considers the impact that their retirement, or termination under various other scenarios, would have on their compensation and benefits.

The CEO and the senior vice president responsible for Human Resources, who is an executive officer, are regularly invited to attend meetings of the committee. The CEO is excused from the meeting during any deliberations or vote on his compensation. No executive officer determines his or her own compensation or the compensation of any other executive officer. As members of the board, the members of the committee receive information concerning the performance of the company during the year and interact with our management. The CEO gives the committee and the board an assessment of his own performance during the year just ended. He also reviews the performance of the other executive officers with the committee and makes recommendations regarding their compensation. The senior vice president responsible for Human Resources assists in the preparation of and reviews the compensation recommendations made to the committee other than for her compensation.

The Compensation Committee’s charter provides that it may delegate its power, authority and rights with respect to TI’s long-term incentive plans, employee stock purchase plan and employee benefit plans to (i) one or more committees of the board established or delegated authority for that purpose; or (ii) employees or committees of employees except that no such delegation may be made with respect to compensation of the company’s executive officers.

Pursuant to that authority, the Compensation Committee has delegated to a special committee established by the board the authority to, among other things, grant a limited number of stock options and restricted stock units (RSUs) under the company’s long-term incentive plans. The sole member of the special committee is Mr. Templeton. The special committee has no authority to grant, amend or terminate any form of compensation for TI’s executive officers. The Compensation Committee reviews the grantall activity of the special committee.

Governance and Stockholder Relations Committee

All members of the G&SRGSR Committee are independent. From April 18, 2014,21, 2016, to April 16, 2015,20, 2017, the committee members were Mr. Sanders (chair), Mr. Carp, Ms. Cox and Mr. Kirk. Since April 17, 2015,21, 2017, the committee members have been Mr. Sanders (chair)(Chair), Mr. Babb, Ms. Cox and Mr. Kirk. The G&SRGSR Committee is generally responsible for:

Making recommendations to the board regarding:

| | ¡ | | The development and revision of our corporate governance principles. |

| | ¡ | | The size, composition and functioning of the board and board committees. |

| | ¡ | | Candidates to fill board positions. |

| | ¡ | | Nominees to be designated for election as directors. |

| | | | |

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | 11 |

| | ¡ | | Compensation of board members. |

| | ¡ | | Organization and responsibilities of board committees. |

| | ¡ | | Succession planning by the company. |

| | ¡ | | Issues of potential conflicts of interest involving a board member raised under TI’s conflict of interest policy. |

| | ¡ | | Election of executive officers of the company. |

| | ¡ | | Topics affecting the relationship between the company and stockholders. |

| | ¡ | | Public issues likely to affect the company. |

| | ¡ | | Responses to proposals submitted by stockholders. |

Reviewing:

| | ¡ | | Contribution policies of the company and the TI Foundation. |

| | ¡ | | Scope of activities of the company’s political action committee. |

| ¡ | | Revisions to TI’s code of conduct. |

Electing officers of the company other than the executive officers.

Overseeing an annual evaluation of the board and the committee.

| | | | |

| | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | 13 |

The G&SRGSR Committee met eightsix times in 2015.2017. The G&SRGSR Committee holds regularly scheduled meetings and reports its activities to the board. Please see page 5See “Director candidate recommendations” and “Stockholder nomination of directors” for a discussion of stockholder nominations and page 8recommendations and “Communications with the board” for a discussion of communications withdetails on how to contact the board.

Board leadership structure

The board’s current leadership structure combines the positions of chairman and CEO, and includes a lead director who presides at executive sessions and performs the duties listed below. The board believes that this structure, combined with its other practices (such as (a) including on each board agenda an opportunity for the independent directors to comment on and influence the proposed strategic agenda for future meetings and (b) holding an executive session of the independent directors at each board meeting), allows it to maintain the active engagement of independent directors and appropriate oversight of management.

The lead director is elected by the independent directors annually. The independent directors have elected Mr. BabbSanders to serve as lead director.director until April 26, 2018, on which date Mr. Blinn will become lead director subject to hisre-election by stockholders. The duties of the lead director are to:

Preside at all meetings of the board at which the chairman is not present, including executive sessions of the independent directors;

Serve as liaison between the chairman and the independent directors;

Approve information sent to the board;

Approve meeting agendas for the board;

Approve meeting schedules to assure that there is sufficient time for discussion of all agenda items; and

If requested by major shareholders, ensure that he or she is available for consultation and direct communication.

In addition, the lead director has authority to call meetings of the independent directors.

The board, led by its G&SRGSR Committee, regularly reviews the board’s leadership structure. The board’s consideration is guided by two questions: would stockholders be better served and would the board be more effective with a different structure. The board’s views are informed by a review of the practices of other companies and insight into the preferences of top stockholders, as gathered fromface-to-face dialogue and review of published guidelines. The board also considers how board roles and interactions would change if its leadership structure changed. The board’s goal is for each director to have an equal stake in the board’s actions and equal accountability to the corporation and its stockholders.

The board continues to believe that there is no uniform solution for a board leadership structure. Indeed, the company has had varying board leadership models over its history, at times separating the positions of chairman and CEO and at times combining the two, and now utilizing a lead director.

Risk oversight by the board

It is management’s responsibility to assess and manage the various risks TI faces. It is the board’s responsibility to oversee management in this effort. In exercising its oversight, the board has allocated some areas of focus to its committees and has retained areas of focus for itself, as more fully described below.

| | | | |

12

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | |

Management generally views the risks TI faces as falling into the following categories: strategic, operational, financial and compliance. The board as a whole has oversight responsibility for the company’s strategic and operational risks (e.g., major initiatives, competitive markets and products, sales and marketing, and research and development)R&D). Throughout the year the CEO discusses these risks with the board during strategy reviews that focus on a particular business or function. In addition, at the end of the year, the CEO provides a formal report on the top strategic and operational risks.

TI’s Audit Committee has oversight responsibility for financial risk (such as accounting, finance, internal controls and tax strategy). Oversight responsibility for compliance risk is shared by the board committees. For example, the Audit Committee oversees compliance with the company’s code of conduct and finance- and accounting-related laws and policies, as well as the company’s compliance program itself; the Compensation Committee oversees compliance with the company’s executive compensation plans and related laws and policies; and the G&SRGSR Committee oversees compliance with governance-related laws and policies, including the company’s corporate governance guidelines.

The Audit Committee oversees the company’s approach to risk management as a whole. It reviews the company’s risk management process at least annually by means of a presentation by the CFO.

| | | | |

14 | | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | |

The board’s leadership structure is consistent with the board and committees’ roles in risk oversight. As discussed above, the board has found that its current structure and practices are effective in fully engaging the independent directors. Allocating various aspects of risk oversight among the committees provides for similar engagement. Having the chairman and CEO review strategic and operational risks with the board ensures that the director most knowledgeable about the company, the industry in which it operates and the competition and other challenges it faces shares those insights with the board, providing for a thorough and efficient process.

Director compensation

The G&SRGSR Committee has responsibility for reviewing and making recommendations to the board on compensation fornon-employee directors, with the board making the final determination. The committee has no authority to delegate its responsibility regarding director compensation. In carrying out this responsibility, it is supported by TI’s Human Resources organization. The CEO, the senior vice president responsible for Human Resources and the Secretary review the recommendations made to the committee. The CEO also votes, as a member of the board, on the compensation ofnon-employee directors.

The compensation arrangements in 20152017 for thenon-employee directors were:

Annual retainer of $85,000 for board and committee service.

Additional annual retainer of $25,000 for service as the lead director.

Additional annual retainer of $30,000 for service as chair of the Audit Committee; $20,000 for service as chair of the Compensation Committee; and $15,000 for service as chair of the G&SRGSR Committee.

Annual grant of a10-year option to purchase TI common stock pursuant to the terms of the Texas Instruments 2009 Director Compensation Plan (Director Plan), which was approved by stockholders in April 2009. The grant date value is $100,000, determined using a Black-Scholes option-pricing model (subject to the board’s ability to adjust the grant downward). Thesenon-qualified options become exercisable in four equal annual installments beginning on the first anniversary of the grant and also will become fully exercisable in the event of termination of service following a change in control (as defined in the Director Plan) of TI. If a director’s service terminates due to death, disability or ineligibility to stand forre-election under the company’sby-laws, or after the director has completed eight years of service, then all outstanding options held by the director shall continue to become exercisable in accordance with their terms. If a director’s service terminates for any other reason, all outstanding options held by the director shall be exercisable for 30 days after the date of termination, but only to the extent such options were exercisable on the date of termination.

Annual grant of restricted stock units pursuant to the Director Plan with a grant date value of $100,000 (subject to the board’s ability to adjust the grant downward). The restricted stock units vest on the fourth anniversary of their date of grant and upon a change in control as defined in the Director Plan. If a director is not a member of the board on the fourth anniversary of the grant, restricted stock units will nonetheless settle (i.e., the shares will issue) on such anniversary date if the director has completed eight years of service prior to termination or the director’s termination was due to death, disability or ineligibility to stand forre-election under the company’sby-laws. The director may defer settlement of the restricted stock units at his or her election. Upon settlement, the director will receive one share of TI common stock for each restricted stock unit. Dividend equivalents are paid on the restricted stock units at the same rate as dividends on TI common stock. The director may defer receipt of dividend equivalents.

| | | | |

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | 13 |

$1,000 per day compensation for other activities designated by the chairman.

Aone-time grant of 2,000 restricted stock units upon a director’s initial election to the board.

The board has determined that annual grants of equity compensation tonon-employee directors will be timed to occur when grants are made to our U.S. employees in connection with the annual compensation review process. Accordingly, such equity grants tonon-employee directors are made in January. Please see theSee “Process for equity grants” for a discussion regarding the timing of equity compensation grants on page 25.grants.

Directors are not paid a fee for meeting attendance, but we reimbursenon-employee directors for their travel, lodging and related expenses incurred in connection with attending board, committee and stockholders meetings and other designated TI events. In addition,non-employee directors may travel on company aircraft to and from these meetings and other designated events. On occasion, directors’ spouses are invited to attend board events; the spouses’ expenses incurred in connection with attendance at those events are also reimbursed.

Under the Director Plan, some directors have chosen to defer all or part of their cash compensation until they leave the board (or certain other specified times). These deferred amounts were credited to either a cash account or stock unit account. Cash accounts earn interest from TI at a rate currently based on Moody’s Seasoned Aaa Corporate Bonds. For 2015,2017, that rate was 4.053.44 percent. Stock unit accounts fluctuate in value with the underlying shares of TI common stock, which will be issued after the deferral period. Dividend equivalents are paid on these stock units. Directors may also defer settlement of the restricted stock units they receive.

| | | | |

| | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | 15 |

We have arrangements with certain customers whereby our employees may purchase consumer products containing TI components at discounted pricing. In addition, the TI Foundation has an educational and cultural matching gift program. In both cases, directors are entitled to participate on the same terms and conditions available to employees.

Non-employee directors are not eligible to participate in anyTI-sponsored pension plan.

20152017 director compensation

The following table shows the compensation of all persons who werenon-employee members of the board during 20152017 for services in all capacities to TI in 2015.2017.

| Name | | Fees Earned or Paid in Cash ($) (2) | | Stock Awards ($) (3) | | Option Awards ($) (4) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings (5) | | All Other Compensation ($) (6) | | Total ($) | | Fees Earned or Paid in Cash ($) (2) | | | Stock Awards ($) (3) | | | Option Awards ($) (4) | | | Non-Equity Incentive Plan Compensation ($) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings (5) | | | All Other Compensation ($) (6) | | | Total ($) | |

R. W. Babb, Jr. | | | $ | 131,667 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | | — | | | | $ | 40 | | | | $ | 331,653 | | | $ | 95,000 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 40 | | | $ | 294,975 | |

M. A. Blinn | | | $ | 85,000 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | | — | | | | $ | 6,540 | | | | $ | 291,486 | | | $ | 105,000 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 40 | | | $ | 304,975 | |

T. M. Bluedorn | | | $ | 70,833 | | | $ | 156,300 | | | | — | | | | — | | | | — | | | $ | 40 | | | $ | 227,173 | |

D. A. Carp | | | $ | 85,000 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | | — | | | | $ | 797 | | | | $ | 285,743 | | | $ | 85,000 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 893 | | | $ | 285,828 | |

J. F. Clark (1) | | | $ | 39,301 | | | | $ | 98,980 | | | | | — | | | | | — | | | | | — | | | | $ | 20,040 | | | | $ | 158,321 | | |

J. F. Clark | | | $ | 85,000 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 20,040 | | | $ | 304,975 | |

C. S. Cox | | | $ | 85,000 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | $ | 2,066 | | | | $ | 10,040 | | | | $ | 297,052 | | | $ | 85,000 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | $ | 5,520 | | | $ | 40 | | | $ | 290,495 | |

J. M. Hobby | | | $ | 85,000 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 40 | | | $ | 284,975 | |

R. Kirk | | | $ | 85,000 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | | — | | | | $ | 40 | | | | $ | 284,986 | | | $ | 85,000 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 40 | | | $ | 284,975 | |

P. H. Patsley | | | $ | 85,000 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | | — | | | | $ | 40 | | | | $ | 284,986 | | | $ | 85,000 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 40 | | | $ | 284,975 | |

R. E. Sanchez | | | $ | 105,000 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | | — | | | | $ | 10,040 | | | | $ | 314,986 | | | $ | 113,333 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 10,040 | | | $ | 323,308 | |

W. R. Sanders | | | $ | 108,333 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | | — | | | | $ | 797 | | | | $ | 309,076 | | | $ | 116,667 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 893 | | | $ | 317,495 | |

R. J. Simmons | | | $ | 85,000 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | $ | 391 | | | | $ | 10,040 | | | | $ | 295,377 | | |

C. T. Whitman | | | $ | 85,000 | | | | $ | 99,951 | | | | $ | 99,995 | | | | | — | | | | | — | | | | $ | 40 | | | | $ | 284,986 | | | $ | 28,335 | | | $ | 99,947 | | | $ | 99,988 | | | | — | | | | — | | | $ | 40 | | | $ | 228,310 | |

| (1) | Ms. ClarkMr. Bluedorn was elected to the board effective July 15, 2015.March 1, 2017. Ms. Whitman, an independent director, reached the age of 70 by the date of the 2017 annual meeting and therefore was ineligible under the company’sby-laws to stand forre-election at the meeting. |

| (2) | Includes amounts deferred at the director’s election. |

| (3) | Shown is the aggregate grant date fair value of restricted stock units granted in 20152017 calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification™ Topic 718, Compensation-Stock Compensation (ASC 718). The discussion of the assumptions used for purposes of calculating the grant date fair value appears in Note 4 to the financial statements contained in Item 8 (“Note 4 to the Financial Statements”financial statements”) in TI’s annual report on Form10-K for the year ended December 31, 2015.2017. Each restricted stock unit represents the right to receive one share of TI common stock. For restricted stock units granted prior to 2007, shares are issued at the time of mandatory retirement from the board (age 70) or upon the |

| | | | |

14

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | |

| earlier of termination of service from the board after completing eight years of service or death or disability. For information regarding share issuances under restricted stock units granted after 2006, please see the discussion on page 13.pages 34-35. The table below shows the aggregate number of shares underlying outstanding restricted stock units held by the named individuals as of December 31, 2015.2017. The value shown for Mr. Bluedorn represents theone-time restricted stock unit grant he received upon his initial election to the board. |

| | | | |

| Name | | Restricted Stock Units (in Shares) | |

R. W. Babb, Jr. | | | 15,14618,296 | |

M. A. Blinn | | | 6,1219,271 | |

T. M. Bluedorn | | | 2,000 | |

D. A. Carp | | | 31,81034,960 | |

J. F. Clark | | | 2,0005,150 | |

C. S. Cox | | | 25,14628,296 | |

J. M. Hobby | | | 3,261 | |

R. Kirk | | | 6,1217,271 | |

P. H. Patsley | | | 12,2599,271 | |

R. E. Sanchez | | | 10,2597,271 | |

W. R. Sanders | | | 19,85916,871 | |

R. J. Simmons

| | | 31,146 | |

C. T. Whitman | | | 22,64620,100 | |

| | | | |

16 | | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | |

| (4) | Shown is the aggregate grant date fair value of options granted in 20152017 calculated in accordance with ASC 718. The discussion of the assumptions used for purposes of calculating the grant date fair value appears in Note 4 to the Financial Statementsfinancial statements in TI’s annual report on Form10-K for the year ended December 31, 2015.2017. The terms of these options are as set forth on page 1334 except that for options granted before 2010, the grant becomes fully exercisable upon a change in control of TI. The table below shows the aggregate number of shares underlying outstanding stock options held by the named individuals as of December 31, 2015.2017. |

| | | | |

| Name | | Options (in Shares) | |

R. W. Babb, Jr. | | | 59,74553,642 | |

M. A. Blinn | | | 22,83821,903 | |

T. M. Bluedorn | | | — | |

D. A. Carp | | | 87,74553,642 | |

J. F. Clark | | | —16,055 | |

C. S. Cox | | | 80,74582,800 | |

J. M. Hobby | | | 6,065 | |

R. Kirk | | | 22,83838,893 | |

P. H. Patsley | | | 87,74589,800 | |

R. E. Sanchez | | | 49,74338,893 | |

W. R. Sanders | | | 59,74538,893 | |

R. J. Simmons

| | | 30,178 | |

C. T. Whitman | | | 87,74589,800 | |

| (5) | SEC rules require the disclosure of earnings on deferred compensation to the extent that the interest rate exceeds a specified rate (Federal Rate), which is 120 percent of the applicable federal long-term interest rate with compounding. Under the terms of the Director Plan, deferred compensation cash amounts earn interest at a rate based on Moody’s Seasoned Aaa Corporate Bonds. For 2015,2017, this interest rate exceeded the Federal Rate by 0.541.18 percentage points. Shown is the amount of interest earned on the directors’ deferred compensation accounts that was in excess of the Federal Rate. |

| (6) | Consists of (a) the annual cost ($40 per director) of premiums for travel and accident insurance policies, (b) contributions under the TI Foundation matching gift program of $6,500 for Mr. Blinn, $20,000 for Ms. Clark and $10,000 for each of Mses. Cox and Simmons and Mr. Sanchez and (c) for Messrs. Carp and Sanders, third-party administration fees for the Director Award Program. Each director whose service commenced prior to June 20, 2002, is eligible to participate in the Director Award Program, a charitable donation program under which we will contribute a total of $500,000 per eligible director to as many as three educational institutions recommended by the director and approved by us. The contributions are made following the director’s death. Directors receive no financial benefit from the program, and all charitable deductions belong to the company. In accordance with SEC rules, we have included the company’s annual costs under the program in All Other Compensation of the directors who participate. The cost attributable to each of Messrs. Carp and Sanders for their participation in this program was $757.$853. |

| | | | |

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | 15 |

Executive compensation

We are providing youshareholders the opportunity to cast an advisory votevotes on named executive officer compensation as required by Section 14A of the Securities Exchange Act. The company holds this vote annually.

Proposal regarding advisory approval of the company’s executive compensation

The board asks the shareholders to cast an advisory vote on the compensation of our named executive officers. The “named executive officers” are the chief executive officer, each person who served as the chief financial officer during 2017 and the three other most highly compensated executive officers, as named in the compensation tables on pages 28-40.30-42.

Specifically, weWe ask the shareholders to approve the following resolution:

RESOLVED, that the compensation paid to the company’s named executive officers, as disclosed in this proxy statement pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the Compensation Discussion and Analysis, compensation tables and narrative discussion on pages 16-4018-42 of this proxy statement, is hereby approved.

We encourage shareholders to review the Compensation Discussion and Analysis section of the proxy statement, which follows. It discusses our executive compensation policies and programs and explains the compensation decisions relating to the named executive officers for 2015.2017. We believe that the policies and programs serve the interests of our shareholders and that the compensation received by the named executive officers is commensurate with the performance and strategic position of the company.

| | | | |

| | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | 17 |

Although the outcome of this annual vote is not binding on the company or the board, the Compensation Committee of the board will consider it when setting future compensation for the executive officers.

The board of directors recommends a vote FOR the annual resolution approving the named executive officer compensation for 2015,2017, as disclosed in this proxy statement.

Compensation Discussion and Analysis

This section describes TI’s compensation program for executive officers. It will provide insight into the following:

The elements of the 20152017 compensation program, why we selected them and how they relate to one another; and

How we determined the amount of compensation for 2015.2017.

Currently,The executive officers of TI has 10 executive officers. These executives have the broadest job responsibilities and policy-making authority in the company. We hold them accountable for the company’s performance and for maintaining a culture of strong ethics. Details of compensation for our CEO, both individuals who served as CFO during 2017 and the three other highest paid individuals who were executive officers in 20152017 (collectively called the “named executive officers”) can be found in the tables beginning on page 28.following the Compensation Committee report.

Executive summary

TI’s compensation program is structured to pay for performance and deliver rewards that encourage executives to think and act in both the short- and long-term interests of our shareholders. The majority of total compensation for our executives each year comes in the form of variable cash and equity compensation. Variable cash is tied to the short-term performance of the company, and the value of equity is tied to the long-term performance of the company. We believe our compensation program holds our executive officers accountable for the financial and competitive performance of TI.

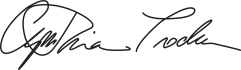

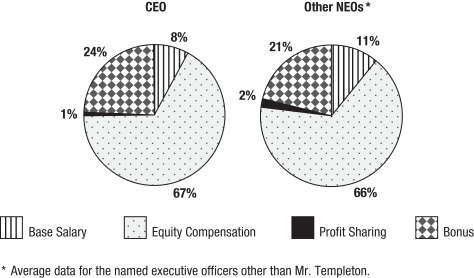

20152017 compensation decisions for the CEO:

| | ¡ | | Base salary was increased by 32.1 percent over 2014.2016. |

| | ¡ | | The grant date fair value of equity compensation awarded in 2015 was unchanged2017 increased by 12 percent from 2014.2016, reflecting an effort to align with the projected market range for similarly situated CEOs in our comparator group. |

| | | | |

16

| | TEXAS INSTRUMENTS • 2016 PROXY STATEMENT | | |

| | ¡ | | The bonus decision was based primarily on the following performance results in 2015:2017: |

| | | | | | |

| | | 20152017 Absolute Performance | | | 20152017 Relative Performance* |

| | |

Revenue Growth: Total TI | | | -0.3%11.9% | | | Median |

| | |

Profit from Operations as a % of Revenue (PFO%)(PFO %) | | | 32.9%40.7% | | | Above median |

| | |

Total Shareholder Return (TSR) | | | 5.2%46.8% | | | MedianAbove median |

| | |

Year-on-Year Change in CEO Bonus (20152017 bonus compared to 2014)with 2016) | | 0%5% change |

| | * | Relative to semiconductor competitors as outlined on page 22. Includesunder “Comparator group;” includes estimates and projections of certain competitors’ financial results. See pages 22-24“Analysis of compensation determinations – Bonus – Assessment of 2017 performance” for details of the Compensation Committee’s assessment of TI’s performance. (It is important to note that the median growth rate of competitor companies includes the effect of acquisitions, whereas TI’s growth rate is entirely organic.) |

Our executive compensation program is designed to encourage executive officers to pursue strategies that serve the interests of the company and shareholders, and not to promote excessive risk-taking by our executives. It is built on a foundation of sound corporate governance and includes:

| | ¡ | | Executive officers do not have employment contracts and are not guaranteed salary increases, bonus amounts or awards of equity compensation. |

| | ¡ | | We have never repriced stock options. We do not grant reload options. We grant equity compensation with double-triggerchange-in-control terms, which accelerate the vesting of grants only if the grantee has been terminated involuntarily within a limited time after a change in control of the company. |

| | | | |

18 | | TEXAS INSTRUMENTS • 2018 PROXY STATEMENT | | |

| | ¡ | | Bonus and equity compensation awards are subject to clawback as described under the committee’s policy described onpages 25-26.“Recoupment policy” below. |

| | ¡ | | We do not provide excessive perquisites. We provide no taxgross-ups for perquisites. |